In today’s digital era, managing personal finances has become easier than ever with the help of mobile apps. With just a few taps on your Android device, you can track expenses, create budgets, invest wisely, and stay on top of your financial goals. To assist you in this endeavor, we have curated a list of the 10 Best Android Apps for Finance that are reliable, user-friendly, and packed with powerful features.

Mint

Mint is a widely popular finance app that offers a comprehensive suite of tools to help you manage your money effectively. It allows you to link your bank accounts, credit cards, and investments in one place, providing a clear overview of your financial situation. With Mint, you can set budgets, track your expenses, receive bill reminders, and even get your free credit score.

- Gain a clear understanding of your financial situation by linking all your accounts in one place.

- Create budgets that align with your financial goals and track your expenses effortlessly.

- Stay on top of your bills with timely reminders and avoid late fees.

- Get insights into your credit score and take steps to improve it.

Personal Capital (Empower)

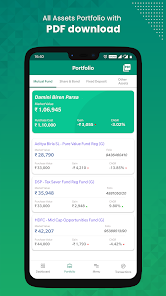

Personal Capital is another exceptional finance app that combines budgeting, investment tracking, and retirement planning. It allows you to sync all your financial accounts, analyze your spending patterns, and create customized budgets. Additionally, Personal Capital provides insightful investment tools to help you make informed decisions and plan for a secure future.

- Easily sync all your financial accounts to get a holistic view of your finances.

- Analyze your spending patterns and identify areas where you can save.

- Create personalized budgets based on your financial goals and track your progress.

- Utilize investment tools to make informed decisions and plan for retirement.

YNAB (You Need a Budget)

YNAB focuses on the principle of zero-based budgeting, which means every dollar has a purpose. This app empowers you to assign money to different categories, track your expenses, and make adjustments as needed. YNAB also offers educational resources and live workshops to help you gain control over your finances and become a smart spender.

- Take control of your money by assigning every dollar a specific purpose.

- Track your expenses effortlessly and make adjustments to your budget as needed.

- Access educational resources and live workshops to improve your financial literacy.

- Gain a better understanding of your spending habits and develop smart spending habits.

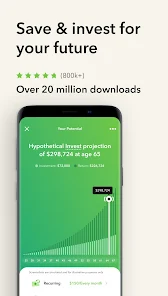

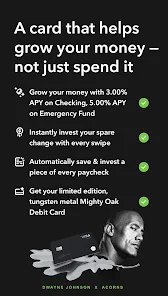

Acorns

Acorns is a unique app that automates your saving and investing process. It rounds up your everyday purchases to the nearest dollar and invests the spare change into a diversified portfolio. This micro-investing approach allows you to grow your wealth gradually without making significant changes to your spending habits. Acorns also offers retirement and checking account options to cater to various financial goals.

- Automatically save and invest your spare change from everyday purchases.

- Benefit from a diversified portfolio without the need for significant investment amounts.

- Choose from retirement and checking account options to align with your financial goals.

- Grow your wealth gradually without impacting your day-to-day spending habits.

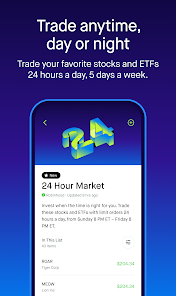

Robinhood

Robinhood is a commission-free investing app that enables you to buy and sell stocks, ETFs, options, and cryptocurrencies without any trading fees. It provides a user-friendly interface with real-time market data, customizable watchlists, and informative charts. With Robinhood, you can start investing with as little as $1 and build your investment portfolio at your own pace.

- Invest in stocks, ETFs, options, and cryptocurrencies without paying any trading fees.

- Stay updated with real-time market data and make informed investment decisions.

- Customize watchlists and use informative charts to track your investments.

- Start investing with as little as $1 and gradually build your investment portfolio.

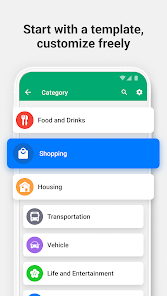

Wallet

Wallet is a versatile finance app that helps you track your expenses, create budgets, and achieve your savings goals. It allows you to categorize and analyze your spending habits, set bill reminders, and receive personalized insights into your financial health. Wallet also offers a shared wallet feature, making it ideal for managing household finances with a partner or family member.

- Easily track your expenses and gain insights into your spending habits.

- Create budgets that align with your savings goals and track your progress.

- Set bill reminders to avoid missing payments and late fees.

- Utilize the shared wallet feature to manage household finances with ease.

Expensify

Expensify is the ultimate app for managing your expenses, especially for business purposes. It simplifies the process of tracking receipts, logging mileage, and generating expense reports. Expensify can automatically import expenses from connected bank accounts and credit cards, saving you time and effort. It is a valuable tool for freelancers, small business owners, and individuals who need to streamline their expense management.

- Streamline your expense management by tracking receipts and logging mileage effortlessly.

- Generate expense reports with ease and save time on manual calculations.

- Automatically import expenses from connected bank accounts and credit cards.

- Ideal for freelancers, small business owners, and individuals who need to manage expenses efficiently.

Investing.com

Investing.com is a comprehensive app for staying updated with the financial markets. It provides real-time quotes, charts, and news from various global exchanges, ensuring you are well-informed about the latest market trends. You can create personalized portfolios, set custom alerts, and access in-depth analysis to make informed investment decisions. Investing.com is an essential tool for both novice and experienced investors.

- Stay updated with real-time quotes, charts, and news from global exchanges.

- Create personalized portfolios and track your investments with ease.

- Set custom alerts to stay informed about market movements.

- Access in-depth analysis to make informed investment decisions.

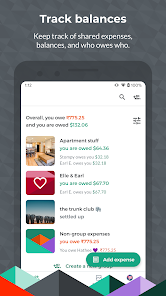

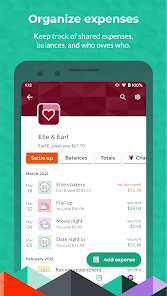

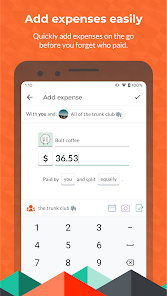

Splitwise

Splitwise is a handy app for tracking shared expenses among friends, roommates, or travel companions. It allows you to split bills, record IOUs, and settle debts effortlessly. Splitwise keeps everyone involved in the loop, ensuring fair and transparent expense management. With its intuitive interface and convenient features, Splitwise eliminates the hassle of manual calculations and simplifies group finances.

- Track shared expenses among friends, roommates, or travel companions.

- Split bills, record IOUs, and settle debts with ease.

- Ensure fair and transparent expense management for everyone involved.

- Eliminate manual calculations and simplify group finances.

PayPal

PayPal is a widely recognized digital payment platform that enables seamless and secure transactions. It allows you to send and receive money, pay bills, and shop online with ease. With PayPal’s mobile app, you can manage your account, check your balance, and even withdraw funds to your linked bank account. The app also offers buyer and seller protection, ensuring a safe and reliable financial experience.

- Seamlessly send and receive money, pay bills, and shop online.

- Manage your PayPal account, check your balance, and withdraw funds with ease.

- Benefit from buyer and seller protection for a safe and reliable financial experience.

- Enjoy the convenience and security of digital transactions with PayPal.

These 10 Android apps for finance are just a glimpse of the vast range of options available to you. Whether you want to track your expenses, invest wisely, or simplify shared finances, there is an app tailored to suit your specific needs. Embrace the power of technology and take control of your financial future with these reliable and feature-rich apps.