As an avid advocate for financial wellness, I am always on the lookout for reliable tools to help me manage my expenses and budget effectively. In today’s digital age, numerous Android apps have made it easier than ever to stay on top of your finances with just a few taps on your smartphone. In this blog post, I will share with you my top 10 picks for the best Android apps for budgeting and expense tracking. These apps come with a wide range of features, from customizable budget categories to automated expense tracking, and can help you take control of your finances while on the go. Whether you are a seasoned budgeter or new to the concept, there is an app on this list that is sure to meet your needs and improve your financial well-being. Keep reading to discover which apps made the cut and how they can benefit you.

Key Takeaways:

- Efficiency: These apps provide efficient ways to track and manage your budget and expenses, helping you stay on top of your financial goals.

- User-Friendly Interface: The best Android apps for budgeting and expense tracking offer a user-friendly interface, making it easy for users to input and access their financial data.

- Customization: Many of these apps allow for customization, enabling users to tailor their budgeting and expense tracking to fit their specific financial needs and goals.

Comprehensive Budgeting Apps

Any effective budgeting app should be able to provide a comprehensive overview of your financial situation, allowing you to track your expenses, set savings goals, and monitor your spending patterns. There are several Android apps available that offer these features, making it easier for you to stay on top of your budget and manage your expenses effectively.

Mint: Budget Management and Credit Monitoring

If you’re looking for a comprehensive budgeting app that also offers credit monitoring, Mint is an excellent choice. With Mint, you can link all of your accounts, including bank accounts, credit cards, loans, and investments, in one place. You can track your spending, set budgeting goals, and receive alerts for unusual account activity. Mint also offers free credit score monitoring and personalized recommendations to help improve your credit score. It’s a powerful tool for managing your finances and staying on top of your budget.

You Need A Budget (YNAB): Proactive Budget Planning

You Need A Budget, often referred to as YNAB, takes a proactive approach to budget planning. It encourages you to give every dollar a job, so you can prioritize your spending and make conscious financial decisions. The app provides real-time budget tracking, goal setting, and debt payoff planning, allowing you to take control of your finances and make progress toward your financial goals. YNAB is ideal for individuals who want to be more hands-on with their budgeting and prioritize their spending effectively.

Simple and Intuitive Expense Trackers

Some of the best Android apps for budgeting and expense tracking are designed to be simple and intuitive, making it easy for you to keep an eye on your spending. These apps offer a range of features that can help you stay on top of your finances and make better decisions about where your money goes. To find out more about the 9 Best Budget Apps for Spending, check out this link 9 Best Budget Apps – Spending.

Wally: Smart Receipt Scanning and Financial Insights

Wally is a budgeting app that stands out for its smart receipt scanning feature and financial insights. With Wally, you can simply take a photo of your receipts and the app will automatically extract the relevant information, making it easy to keep track of your expenses. Additionally, Wally provides valuable insights into your spending habits, helping you identify areas where you can save and make better financial decisions.

Goodbudget: The Envelope Method Goes Digital

Goodbudget is an Android app that brings the envelope budgeting method into the digital age. With Goodbudget, you can allocate your income into different virtual envelopes for various expenses, such as groceries, entertainment, and bills. This allows you to easily see how much you have left to spend in each category and helps you stick to your budget. Goodbudget also offers syncing across multiple devices and provides reports to help you analyze your spending patterns.

Innovative Apps for Financial Goals

Your financial goals are important, and there are a variety of innovative apps available to help you achieve them. Whether you want to save for a vacation, pay off debt, or build an emergency fund, these apps can provide the tools and insights you need to stay on track. Check out the 10 best budgeting apps on Android in 2023 to find the perfect app for your financial goals.

PocketGuard: Alleviate the Hassle of Overspending

If you struggle with overspending and need a simple way to stay on top of your budget, PocketGuard is the solution for you. This app automatically syncs with your financial accounts to give you a clear view of your income, expenses, and goals. It categorizes your transactions and helps you set realistic spending limits for different categories. The app’s smart algorithms analyze your cash flow and provide personalized tips to save money and avoid unnecessary expenses. With PocketGuard, you can alleviate the hassle of overspending and take control of your finances effortlessly.

Wallet by BudgetBakers: Financial Planning and Analysis

When it comes to financial planning and analysis, Wallet by BudgetBakers stands out as a comprehensive tool for tracking your expenses and reaching your financial goals. This app offers features like budget tracking, bill reminders, and customizable reports to help you gain a clear understanding of your financial situation. With secure cloud sync and multi-currency support, Wallet ensures that you have access to your financial data anytime, anywhere. The app’s intuitive interface and powerful analytics make it easy to stay organized and make informed financial decisions. Whether you want to create a personalized budget, track your spending habits, or achieve long-term financial goals, Wallet by BudgetBakers is a valuable companion on your financial journey.

Specialized Budgeting Apps

Keep track of your budget and expenses with specialized budgeting apps that offer unique features to help you manage your finances more effectively. These apps cater to specific budgeting methods and provide tools tailored to your financial needs.

Mvelopes: Mastering the Envelope System Electronically

If you’re a fan of the envelope budgeting system but prefer to go paperless, Mvelopes is the perfect app for you. This app allows you to allocate funds to virtual envelopes for different spending categories. You can set your budget for each envelope, and as you spend, the app automatically deducts the amount from the corresponding envelope. This app helps you visually allocate your money, prevent overspending, and track your expenses in real time.

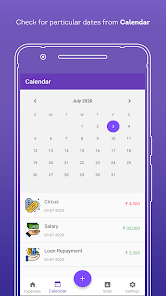

EveryDollar: Dave Ramsey’s Zero-Based Budgeting Approach

EveryDollar is based on Dave Ramsey’s zero-based budgeting method, which means every dollar has a specific job in your budget. With this app, you can create a comprehensive budget, track your spending, and adjust as needed throughout the month. EveryDollar’s focus on every dollar having a purpose helps you stay intentional with your spending and ensures that all your income is allocated, leaving no room for surprises or overspending.

Apps for Investors and Savers

Unlike budgeting apps, these apps are more focused on helping you grow your wealth and make the most out of your savings. Whether you’re a seasoned investor or just starting out, these apps can help you track your investments and save for the future.

Personal Capital: Investment Tracking and Net Worth Overview

Personal Capital is a comprehensive financial planning tool that allows you to track all of your investments in one place. It provides a complete overview of your net worth, including your assets and liabilities. With Personal Capital, you can easily monitor your investment portfolio’s performance and analyze your asset allocation to ensure that you are on track to meet your financial goals. The app also offers personalized investment advice and recommendations to help you make informed decisions about your investments.

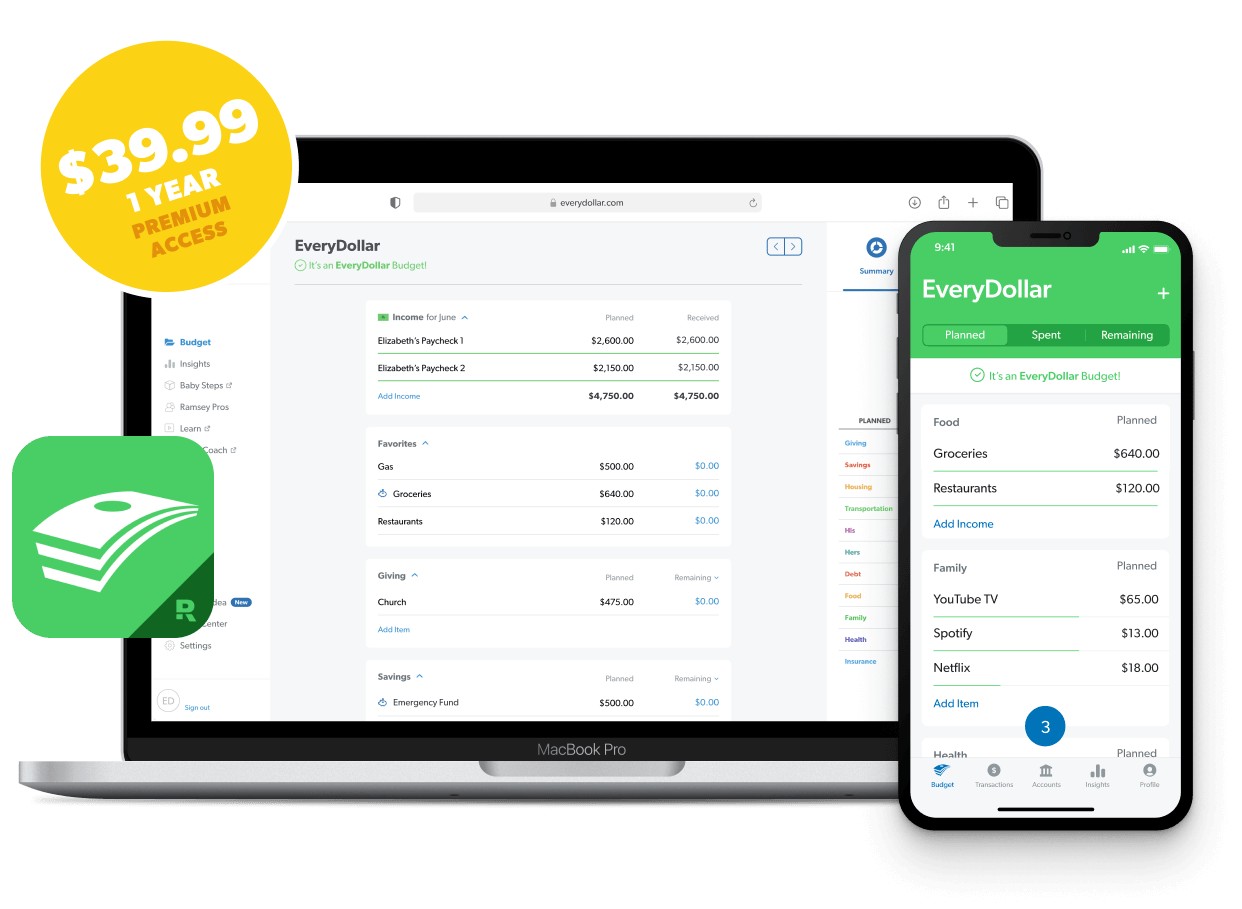

Acorns: Save While You Spend with Micro-Investing

Acorns is a unique app that rounds up your everyday purchases to the nearest dollar and invests the spare change for you. This micro-investing approach allows you to effortlessly save and invest money without even noticing. Acorns also offers a range of investment portfolios tailored to your financial goals and risk tolerance, making it easy for you to start growing your wealth. The app also provides personalized recommendations to help you make the most of your savings and investments.

Conclusion

Presently, I have introduced you to the 10 best Android apps for budgeting and expense tracking. These apps can help you effectively manage your finances, track your spending, and reach your financial goals. Whether you are looking to save money, pay off debt, or simply gain a clearer picture of your financial health, these apps offer a variety of features to suit your needs. By incorporating one or more of these budgeting apps into your financial routine, you can take control of your money and make informed decisions about your spending. With the convenience of mobile technology, there is no excuse not to have your finances in order. Take advantage of these powerful budgeting tools and start working towards a brighter financial future today.

FAQ

Q: What are the 10 best Android apps for budgeting and expense tracking?

A: The 10 best Android apps for budgeting and expense tracking are Mint, YNAB (You Need a Budget), Goodbudget, PocketGuard, Wally, Personal Capital, Mvelopes, Money Lover, Expense IQ, and Honeydue.

Q: Are these budgeting and expense tracking apps safe and secure to use?

A: Yes, these apps prioritize the security of your financial information. They use encryption and secure servers to protect your data. However, it is important to always use a strong, unique password and enable two-factor authentication for added protection.

Q: Do these budgeting apps offer customizable features for different financial situations?

A: Yes, most of these apps offer customizable features to fit different financial situations and goals. They allow you to set budget categories, savings goals, and expense tracking parameters based on your individual needs. Additionally, some apps provide tools for investment tracking and retirement planning.