Perusing through the myriad of Android apps available for investment portfolio management can be a daunting task. As an investor, efficiency, accuracy, and security are of the utmost importance when it comes to managing your investment portfolio. That’s why I’ve curated a list of the 10 Best Android Apps for Investment Portfolio Management that have been tried and tested to provide you with the best tools to monitor, analyze, and grow your investments. Whether you’re a seasoned investor or just getting started, these apps offer a range of features to meet your specific needs and make managing your portfolio easier than ever.

Key Takeaways:

- Diverse Functionality: The top Android investment portfolio management apps offer a range of features, such as real-time tracking, customizable portfolios, and investment research tools.

- User-Friendly Interface: These apps provide an intuitive and easy-to-use interface for investors to manage their portfolios efficiently, regardless of their experience level.

- Secure and Reliable: The best Android apps for investment portfolio management prioritize data security and provide reliable performance to ensure the safety and accuracy of financial information.

10 Best Android Apps for Investment Portfolio Management

Mint: Personal Finance & Money

- Features:

- Comprehensive expense tracking and categorization.

- Investment tracking and performance analysis.

- Budget creation and management.

- Credit score monitoring.

- Bill payment reminders and scheduling.

- Pros:

- User-friendly interface and easy navigation.

- Integrates various financial accounts for a holistic view.

- Offers free credit score tracking.

- Cons:

- Contains ads and product recommendations.

- Investment tracking is relatively basic.

- Some users report issues with account synchronization.

- Price: Free (with in-app advertisements).

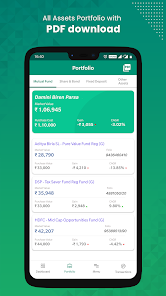

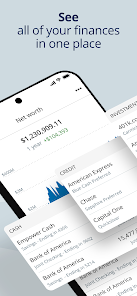

Personal Capital – Now EMPOWER

- Features:

- Advanced investment tracking and management.

- Net worth calculation and retirement planner.

- 401(k) fee analyzer and investment checkup.

- Cash flow analysis and budgeting tools.

- Access to human financial advisors.

- Pros:

- Excellent tools for high-level investment management.

- Provides a comprehensive financial dashboard.

- Free financial tools with optional wealth management services.

- Cons:

- High minimum investment for wealth management services.

- Some features are geared more towards affluent users.

- Limited budgeting tools compared to other apps.

- Price: Free for basic tools; wealth management services have varying fees.

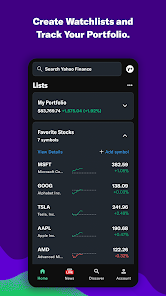

Yahoo Finance

- Features:

- Real-time stock updates and market news.

- Personalized portfolio tracking.

- Interactive charts and historical data analysis.

- Stock screener and research tools.

- Price alerts and investment insights.

- Pros:

- Comprehensive market news and data.

- Customizable portfolio dashboard.

- Useful for active traders and market followers.

- Cons:

- Some advanced features require a premium subscription.

- Advertisements in the free version.

- Interface can be overwhelming for beginners.

- Price: Free; Premium version available at a monthly fee.

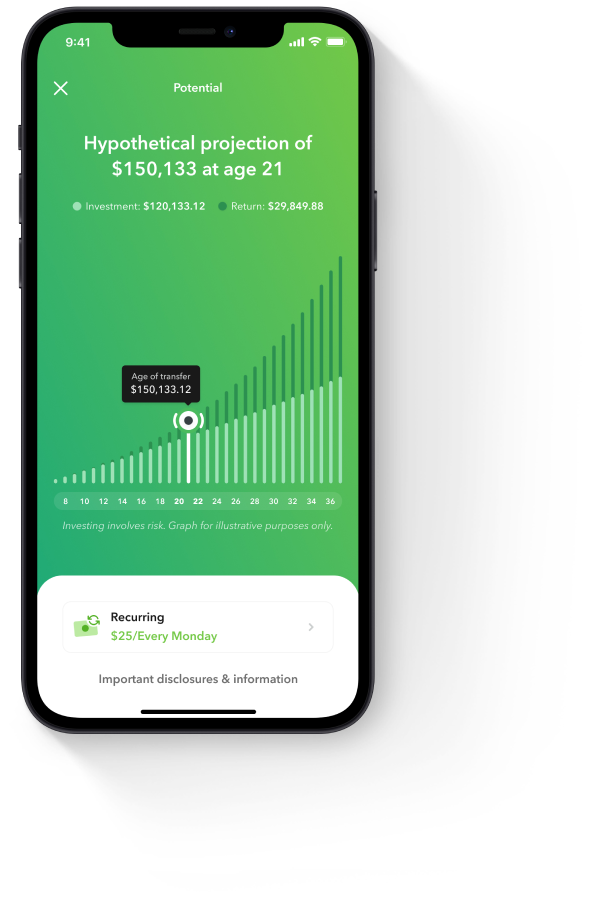

Acorns

- Features:

- Automated micro-investing by rounding up purchases.

- Customizable portfolio options based on risk tolerance.

- Retirement savings account options (IRA).

- Educational content on investing and personal finance.

- Earn extra investment money from shopping rewards.

- Pros:

- Simplifies investing for beginners.

- Encourages consistent saving habits.

- Offers cashback at certain retailers.

- Cons:

- Monthly fee regardless of account balance.

- Limited investment portfolio customization.

- Not ideal for active traders or high-balance investors.

- Price: Monthly subscription fee, varies based on plan.

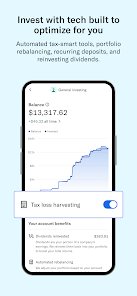

Betterment

- Features:

- Automated investing based on personalized goals.

- Tax-loss harvesting and portfolio rebalancing.

- Access to human advisors for personalized advice.

- Socially responsible investing options.

- Retirement planning tools and account types.

- Pros:

- User-friendly platform for beginners.

- Offers both automated and human advisor services.

- Efficient tax strategies for investment accounts.

- Cons:

- Fees may be higher compared to self-managed accounts.

- Limited investment options compared to traditional brokers.

- No direct indexing for smaller accounts.

- Price: Annual fee based on account balance; additional fees for human advisor services.

Fidelity Investments

- Features:

- Wide range of investment options including stocks, bonds, ETFs.

- Advanced research tools and market analysis.

- Retirement and tax planning tools.

- Customizable alerts and multi-account management.

- Robust educational resources and customer support.

- Pros:

- No minimum to open an account and low fees.

- Comprehensive research tools and investment options.

- Excellent customer service and educational resources.

- Cons:

- Platform can be complex for beginners.

- Some account types have higher fees.

- Mobile app experience may vary from the web platform.

- Price: Free app; various fees for trades and certain account types.

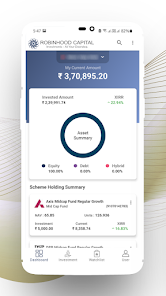

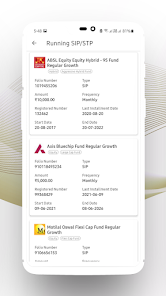

Robinhood

- Features:

- Commission-free trades of stocks, ETFs, and cryptocurrencies.

- Simple, intuitive app interface.

- Instant deposits and real-time market data.

- Fractional shares trading.

- Cash management account options.

- Pros:

- No commission fees for basic trading.

- User-friendly platform, ideal for beginners.

- Offers cryptocurrency trading.

- Cons:

- Limited research and analysis tools.

- No retirement accounts or mutual fund offerings.

- Has faced regulatory scrutiny and reliability issues.

- Price: Free basic account; Robinhood Gold subscription available for a fee.

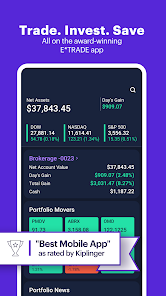

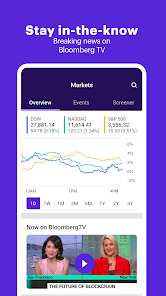

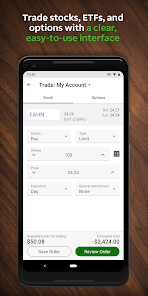

E*TRADE

- Features:

- Extensive range of investment choices including stocks, bonds, ETFs, and mutual funds.

- Advanced trading platforms and tools for active traders.

- Retirement planning and investment guidance.

- Educational resources for investors of all levels.

- Robo-advisor options for automated investing.

- Pros:

- No commission fees on most stock, ETF, and options trades.

- Powerful trading platforms and tools.

- Comprehensive educational content.

- Cons:

- Platform can be overwhelming for beginners.

- Higher fees for certain transactions and services.

- Some features are locked behind higher account balances.

- Price: Free app; various fees for trades, premium platforms, and advisory services.

Wealthfront

- Features:

- Automated investment management using modern portfolio theory.

- Tax-loss harvesting and portfolio rebalancing.

- High-interest cash account options.

- College savings and retirement planning tools.

- Financial planning with Path tool.

- Pros:

- Low account minimum and management fees.

- Advanced tax optimization strategies.

- User-friendly interface and automated financial planning.

- Cons:

- Limited human advisor interaction.

- No individual stock investments.

- Withdrawal process can be slow.

- Price: Management fee based on account balance; no trading commissions.

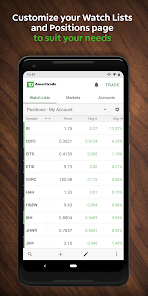

TD Ameritrade

- Features:

- Wide range of investment products including stocks, bonds, ETFs, options, and more.

- Advanced trading tools and platforms (thinkorswim).

- Comprehensive research and educational materials.

- Retirement planning and portfolio guidance.

- No minimum account balance and free research tools.

- Pros:

- Extensive investment options and research tools.

- Powerful platform for active traders (thinkorswim).

- No commission fees on online stock, ETF, and option trades.

- Cons:

- Platform complexity may intimidate beginners.

- Some advanced tools require a learning curve.

- Higher broker-assisted trade fees.

- Price: Free app; fees for certain advanced services and broker-assisted trades.

Criteria for Selecting Top Investment Apps

One of the key aspects to consider when choosing investment apps is the criteria they should meet to be considered top choices for managing your portfolio. As an experienced investor, I have determined several important factors that can help you make the right decision. These factors include security and reliability, user interface and accessibility, account management features, research tools, and customer support.

Security and Reliability

When it comes to managing your investment portfolio through an app, security and reliability should be at the top of your priority list. You want to ensure that your financial information and transactions are safe and protected from any potential threats. Look for investment apps that offer end-to-end encryption and two-factor authentication to protect your account from unauthorized access. Also, consider the reputation and track record of the app’s developer to gauge its reliability.

User Interface and Accessibility

The user interface of an investment app plays a vital role in enhancing your overall experience. You want an app that is intuitive and easy to navigate, allowing you to access your portfolio, track performance, conduct research, and execute trades with ease. Look for apps that offer real-time updates, customizable dashboards, and mobile accessibility so you can manage your investments on the go. A user-friendly interface and accessibility across multiple devices will ultimately save you time and effort in portfolio management.

Comprehensive Review of the Apps

Some of the best Android apps for managing your investment portfolio offer a wide range of features to help you stay on top of your finances. If you’re looking for a comprehensive list of the top apps for stock portfolio management on Android, check out the Stock Portfolio Management Applications for Android – GetApp. This list includes apps that cater to both seasoned investors and beginners, ensuring there’s something for everyone.

Feature-Rich Apps for Seasoned Investors

For seasoned investors, it’s essential to have access to feature-rich apps that provide in-depth analysis and advanced portfolio management tools. These apps often offer customizable dashboards, real-time market data, and advanced charting capabilities. They also provide options for setting up alerts and notifications for price movements, news updates, and earnings reports. Some apps even offer advanced analytical tools for evaluating performance and risk. These features are crucial for experienced investors who need to make informed decisions based on a wide range of data.

Intuitive Apps for Beginners

For beginners, it’s important to have access to intuitive apps that are easy to navigate and understand. These apps often offer a streamlined user interface with easy-to-use portfolio tracking and basic analysis tools. They may also provide educational resources, investment articles, and beginner-friendly guides to help you understand the basics of investing. Additionally, some apps offer simulated trading platforms, allowing new investors to practice their skills without risking real money. These features are essential for newcomers to the world of investing who are looking to build their knowledge and confidence.

Integration with Brokers and Real-time Analytics

Despite the popularity of investment portfolio management apps, not all of them offer seamless integration with brokerage accounts and real-time analytics. When choosing an app for managing your investment portfolio, it’s important to consider how well it integrates with your broker and the level of real-time analytics it provides. According to Forbes, some of the best investing apps for portfolio management of January … can provide advanced real-time analytics and seamless integration with a wide range of brokers.

Broker Connectivity Options

When it comes to managing your investment portfolio, having an app that seamlessly connects with your brokerage account is crucial. Some apps offer direct integration with major brokerage firms, allowing you to view and manage your portfolio directly from the app. This can save you time and provide a more accurate and comprehensive view of your investments. Furthermore, having the ability to execute trades and transfer funds seamlessly from the app can significantly streamline your investment management process.

Real-time Data and Investment Tracking

Real-time data and investment tracking are essential features for effective portfolio management. With real-time analytics, you can monitor the performance of your investments as they happen, allowing you to make informed decisions promptly. Some apps offer advanced tracking features, including customizable watchlists, market data, and performance analytics. Having access to real-time data and investment tracking can help you stay ahead of market trends and identify potential opportunities or risks in your portfolio. Additionally, the ability to set up personalized alerts for price movements and news updates can help you stay informed and make timely investment decisions.

Advanced Tools and Features

To effectively manage your investment portfolio, it’s essential to have access to advanced tools and features that can help you make informed decisions and optimize your portfolio. Here are some key features to look for in investment portfolio management apps:

- Real-time market data: Access to real-time stock market data and news updates can help you stay on top of market trends and make timely investment decisions.

- Performance analytics: Detailed performance analytics can help you track the performance of your portfolio, analyze your investment returns, and identify opportunities for improvement.

- Asset allocation tools: Tools for asset allocation can help you diversify your portfolio and manage risk effectively.

- Research tools: Access to research tools and investment analysis reports can help you make well-informed investment decisions.

Automated Portfolio Rebalancing

Automated portfolio rebalancing is a key feature of advanced investment portfolio management apps. I highly recommend using this feature, as it can help you maintain the desired asset allocation in your portfolio without the need for manual intervention. By setting specific target allocations for different asset classes, the app automatically rebalances your portfolio by buying or selling assets to bring it back in line with your targets. This can help you maintain a well-diversified portfolio and manage risk effectively.

Tax Optimization Strategies

Another important feature to look for in an investment portfolio management app is tax optimization strategies. I highly recommend using an app that offers tax optimization features, as it can help you minimize your tax liabilities and maximize your after-tax investment returns. These features may include tax-loss harvesting, tax-efficient asset placement, and tax-sensitive investment strategies. By implementing these strategies, you can potentially increase your after-tax returns and improve the overall tax efficiency of your investment portfolio.

The 10 Best Android Apps for Investment Portfolio Management

The selection of apps discussed in this article are all powerful tools for managing and tracking your investment portfolios on your Android device. These apps offer a wide range of features that cater to different investing needs and styles, including real-time stock quotes, customizable watchlists, portfolio analysis tools, and investment news and research. With the right app, you can easily stay on top of your investments, make informed decisions, and ultimately work toward your financial goals.

FAQ

Q: What are the best Android apps for investment portfolio management?

A: Some of the best Android apps for investment portfolio management include Robinhood, Acorns, and Stash. These apps offer features such as real-time stock tracking, investment advice, and the ability to buy and sell stocks directly from your phone.

Q: Are these investment apps safe to use?

A: Yes, the investment apps mentioned are considered safe to use. They use encryption and other security measures to protect your personal and financial information. Additionally, they are regulated by financial authorities to ensure compliance with industry standards.

Q: What features should I look for in an investment portfolio management app?

A: When selecting an investment portfolio management app, look for features such as intuitive user interface, real-time market data, customizable alerts and notifications, investment tracking and performance analysis tools, and the ability to set and track financial goals. It’s also important to choose an app that offers low fees and commissions for trading.